“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it” ~ Warren Buffett

The biggest challenge for long-term investors is seeing past short-term market noise. This was summed up best by Benjamin Graham who said, “in the short run, the market is a voting machine but in the long run, it is a weighing machine.” There are always issues that could affect markets, especially in the near-term, and this is reflected in knee-jerk investor reactions. However, only a few events of actual substance will drive markets in the long run.

Today's market environment is no different. The major sources of investor concern are around the Fed, trade wars, oil prices, and tech stocks, just to name a few. There have been developments around each of these in recent weeks which have contributed to greater stability in global markets. For instance, rightly or wrongly, the Fed is showing signs of reconsidering its rate hike path, there appears to be a trade war truce between China and the U.S., Russia and Saudi Arabia have agreed to limit oil production, and tech stocks have rebounded somewhat. New headlines add to these stories on a daily basis.

The beauty of long-term investing is that it's not only unnecessary to follow every headline, but it's actually beneficial to ignore this noise. Long-term investors recognize that markets can be extremely volatile over the course of days, weeks and months as investors "vote." But the market is still the best way to grow wealth over the course of years and decades as it weighs what really matters. And in most cases, what matters is the overall path of economic growth and corporate earnings.

From this perspective, it's clear that the economy is still healthy, but that we're later in the business cycle. U.S. stocks are still attractive but are no longer cheap. Corporate earnings have been extremely strong in 2018 but will likely slow their pace of growth in the coming years. It's not necessary to follow the market play-by-play to know that it's important to stay balanced and diversified in this environment.

We think the following three charts are relevant to our current environment.

1. Global markets have stabilized somewhat

Global Stock Market Performance

Find this chart under "Global Stocks"

Global stocks have been volatile in 2018, after an extremely calm 2017. It's important for all investors to understand that this level of volatility is normal for markets. Over the long run, those who can stay invested are often rewarded. Fortunately, markets have stabilized a bit recently, providing investors with some breathing room.

2. Oil prices are one concern driving markets

Oil and the Stock Market

Find this chart under "Global Oil"

Oil has been a source of volatility due to its collapse from over $75 per barrel to around $50 over the past two months. Oil is important since it is still the lifeblood of the global economy. While lower oil prices may be positive for many sectors over time, this is balanced against the immediate effects on the oil industry and other economic linkages such as the U.S. dollar.

The last time oil prices collapsed was from 2014 to 2016, evident in the chart above. This led to a decline in the U.S. energy industry which had been expanding rapidly due to new innovations and technologies, which fueled rising stock prices and high yield debt. The collapse led to a large decline in corporate earnings and caused stock returns to stagnate, especially in 2016.

Today, the impact on the U.S. stock market should be more limited. The S&P 500 energy sector is half the size it was then, and the industry is better structured. Still, it's another reason to expect overall earnings growth to slow over the coming quarters and is another reason for investors to stay balanced.

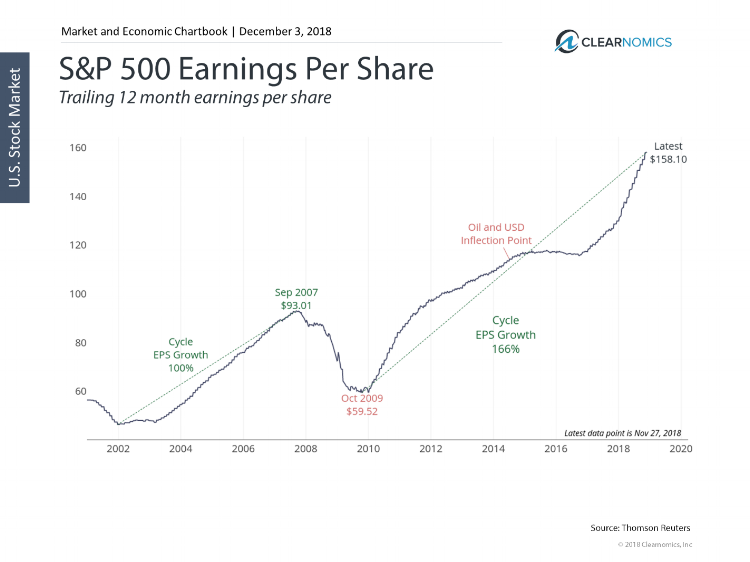

3. Earnings growth is near a peak but should still support market returns

S&P 500 Earnings Per Share

Find this chart under "Corporate Earnings"

Corporate profits have been a dominant driver of markets over the past nine years. Earnings have risen 166% since the recession, propelling stocks to new highs over this period. While earnings growth flat lined from 2014-2016 due to collapsing oil prices and a spike in the U.S. dollar, these effects eventually subsided.

However, after spectacular earnings in 2018, it's possible that we're near a peak in the growth rate. This simply means that the rate of growth will decelerate - not that earnings will actually fall. Slower growth will also mean lower expected returns. So, while U.S. stocks are still attractive, investors should focus on staying balanced by including fixed income and international investments in their portfolios.

The bottom line? Ignoring day-to-day market noise can be challenging. However, those investors who are able to do so are more likely to achieve their long-term financial goals.

As we close out 2018, we sincerely with you and yours the happiest of holiday seasons and want you to know how much we appreciate you & your support.

Brett Steve Becky

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.

This document may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of TRUE Private Wealth Advisors, LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.

This is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

Nothing provided herein constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors.

Any reproduction or distribution of this presentation, as a whole or in part, or the disclosure of the contents hereof, without the prior consent of TRUE Private Wealth Advisors, LLC, is prohibited.